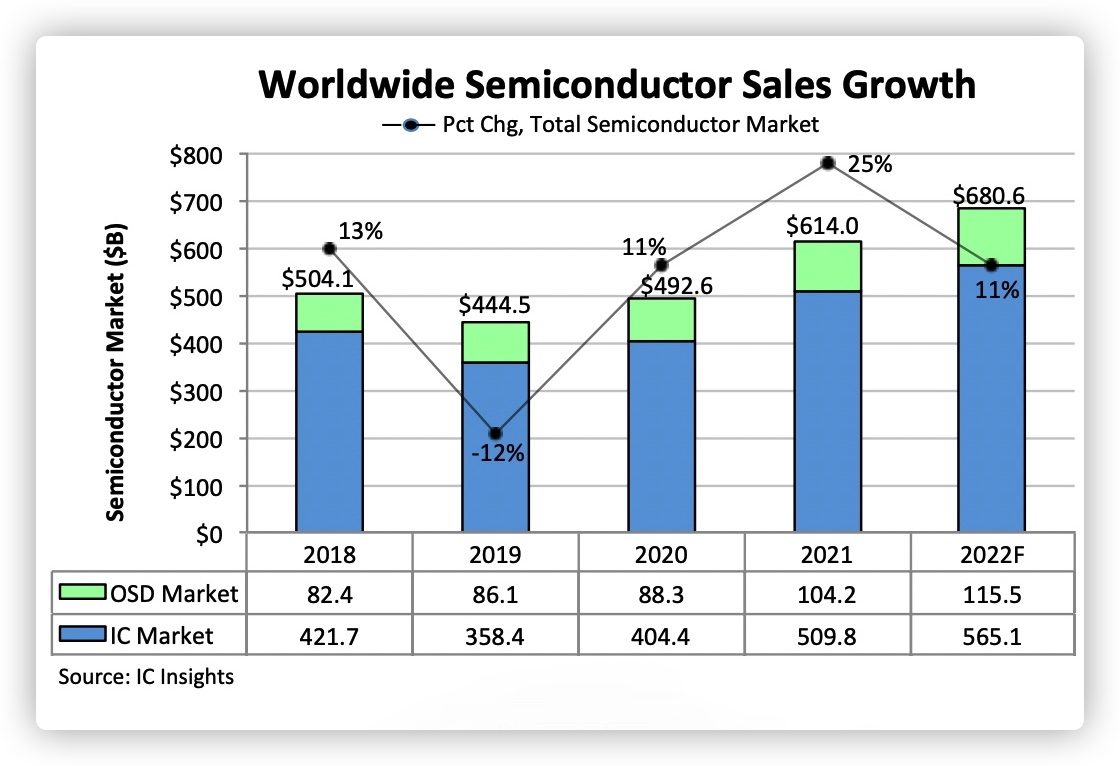

Above average increases are expected in all major product categories, which will lift the global market to record-high revenues in 2022 despite growth rates easing from last year’s economic rebound, says report. Total semiconductor sales in 2022 are forecast to grow 11% and reach a record-high USD 680.6 billion after worldwide revenues climbed 25% in the 2021 economic rebound from the 2020 outbreak of the Covid-19 virus crisis. Sales growth is expected to slow, but remain above average, in all major semiconductor product categories.

Worldwide integrated circuit revenues are expected to rise 11% in 2022 to an all-time high of USD 565.1 billion and the rest of the semiconductor market—consisting of optoelectronics, sensors/actuators, and discretes (collectively, O-S-D devices)—is also projected to grow 11% this year to a record-high USD115.5 billion.

In the 2021 economic turnaround, unit shipments of many widely used semiconductor products could not keep up with increasing demand from system and equipment manufacturers (including carmaker) that struggled to keep up with recoveries in their own markets. Unit purchases of ICs climbed 22% while shipments of O-S-D devices increased 20%. Those were amazing gains considering that over the past 10 years, IC shipments have increased by a compound average growth rate (CAGR) of 7.4% and O-S-D units have increased by a CAGR of 4.7%. New forecasts that more than 1.3 trillion semiconductor devices—about 432.0 billion ICs and 889.3 billion O-S-D devices—are expected to ship in 2022, an increase of 10% for both segments. IC Insights has updated its comprehensive forecast and analysis of the worldwide semiconductor industry.

Semiconductor Industry Flash Report, which will be followed throughout 2022 by major quarterly updates providing refreshed five-year forecasts for all IC and O-S-D product categories (sales, unit shipments and average selling prices), assessments of GDP and the global economic conditions impacting chip markets, and analysis of industry capital spending. Quarterly updates in February, May, August, and November will also provide quarterly sales rankings of top semiconductor suppliers as well as dive into major industry trends, such as IC wafer foundry expansion, R&D spending, mergers and acquisitions, regional market growth, and analysis of IC revenue by end-use categories.

Being a key supplier of packing materials for semiconductor industry in Singapore, Malaysia, Thailand and the Philippines, Nexteck Singapore Pte Ltd is also optimistic in the supply of WLCSP carrier tapes and precession cover tapes for semiconductors, and precision electronics parts. The Strong demand and inflows of new order and forecast from the E-Cars and mobile communication device end customers have spoken for all.