As the world prepares to gather for the United Nations' COP26 climate conference in early November, green mobility is in focus. Road transport accounts for 10% of global emissions.

To get more EVs on their roads, ASEAN governments face the challenge of sharpening policies to spur production and adoption in the coming years.

As of Aug 2021, in Singapore 1,855 out of the 641,977 passenger cars were fully electric, according to the Land Transport Authority. Still, last year, the City State said it intends to entirely phase out vehicles with internal combustion engines by 2040.

Indonesia has set a target of 2,400 charging stations and 10,000 battery swap stations by 2025. By 2030, it aims to have over 31,000 charging stations, as the government projects more than 2 million electric cars and 13 million electric motorbikes will hit the streets by that year. The country also hopes to leverage its nickel resources to become a major battery production base.

Thailand is the region's largest auto production Center has planned to lift output of purely electric vehicles to 50% of all car manufacturing by 2030, and to only allow EVs to be sold from 2035. EVs made up well below 1% of total registered vehicles last year.

The Philippines does not have a clear, defined EV roadmap yet. The Department of Energy also published a circular on protocols for charging stations. But there were fewer than 140 as of July, according to local media, and proponents say the country still lacks an overarching EV law to encourage adoption.

Malaysia reportedly has a Low Carbon Mobility Blueprint that proposes a push for 7,000 AC chargers and 500 faster DC chargers, while a far loftier figure of 125,000 chargers by 2030 has also been reported. The blueprint calls for tax breaks for hybrids and fully battery-powered EVs as well.

Foxconn, the giant Taiwanese contract manufacturer known for supplying Apple, and Thai state energy group PTT last week agreed on setting up a joint venture to develop an EV production platform, vowing to invest up to US$2 billion.

This EV auto production and new facilities has strong demands of electronic shunts which is also reflected in the PO of Nexteck Advanced Materials Group, www.nexteck.com for raw materials on Resistance Alloys.

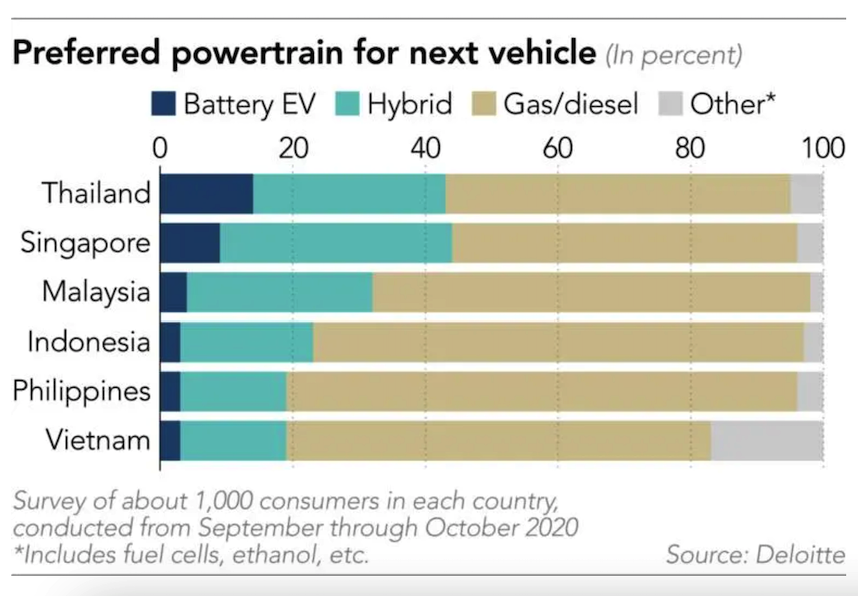

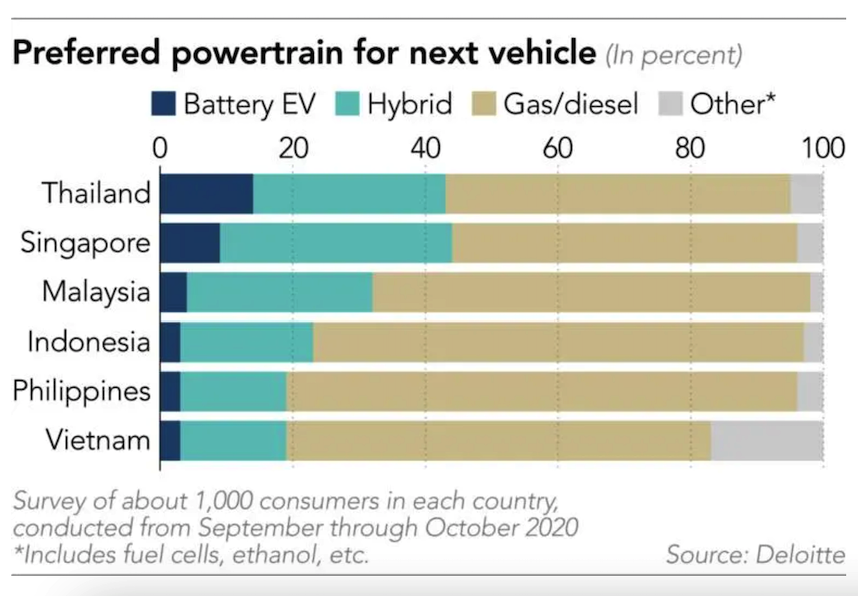

However, 33% percent of respondents cited the lack of EV charging infrastructure as the main sticking point. Price was flagged by 16%, by 2023, the cost of the average battery pack will fall to US$101 per kilowatt-hour, the price point that automakers should be able to produce and sell mass market EVs at the same price as comparable internal combustion vehicles in some markets.

The Electronic Vehicles development in short and longer term has dramatically changed the game in electronics components and chips industries. The strong inflow for urgent push in order and the medium term of 3 years forecasts from semiconductors customers for Nexteck Singapore Pte Ltd., Which focus on NEXTECK WLCSP carrier tapes, cover tapes, T&R, Dicing tapes. These has truly given us a concrete road map for further deployment of resources and extend Nexteck plants capacity.